What is off-site construction?

Off-site construction is sometimes referred to as modular or Modern Methods of Construction (MMC) housing. It’s constructed off-site, normally in a factory with your property then transported to your land and constructed in a very quick, accurate and energy-efficient manner.

Is this off-site build mortgage available through all suppliers?

Our off-site build mortgage is only available when you are purchasing your build through one of our selected suppliers – please see ‘our suppliers’ section.

Which off-site build mortgage is most suitable for me?

We offer a range of mortgages to accommodate all customer types. We recognise that significant, upfront payments are required to the manufacturer to ensure the property can be funded and build off-site. We identified this as a general problem in the off-site market which is why we developed our innovative off-site build (advanced payment) mortgage.

Do I need to provide planning permission for my build?

Yes. We need at least outline planning permission to start the application process and detailed planning permission before the mortgage is released.

What information do I need to progress a mortgage application?

You’ll need to have a specific plot and build in mind which needs to be supported by detailed plans, including a breakdown of the building contract costs provided from your building manufacturer.

What deposit do I need for my build?

You need a 20% minimum deposit to buy the land and a further 15% – 20% of total build costs to start your build. The level of deposit you have available will determine which off-site build mortgage you take from our mortgage range.

Do I still need a deposit for my build if I already own the land and have planning permission?

No, you don’t always need a deposit; we can lend based on the value of your land to start the build, providing you already own the land and it’s mortgage-free. Also, if you need us to, we can help you repay any outstanding finance on the land.

How long do I have to complete the build?

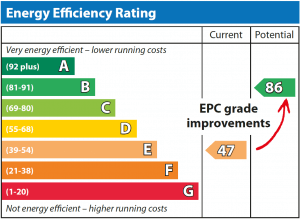

Subject to planning constraints, we allow a maximum of 2 years for you to complete the self-build, although we encourage you to complete earlier to benefit from our C-Change sustainable homes discount which is applied to our Standard Variable Rate from the date we receive evidence that both the work has been completed and the Energy Standard rating required has been achieved.

Can I have interest-only during the build phase?

We offer an interest-only mortgage only when you have a qualifying repayment vehicle to support this for example an established ISA, endowment policies or Pension Plan.

Does the build property have to be my main residence?

Yes. Please bear in mind that the property can’t be a second or holiday home or classed as mobile planning.