Stay up to date with the latest changes to our savings accounts.

We’re pleased to announce that we’ve made some changes to our savings accounts. We’ve made these changes following feedback from our Members. These changes applied from 5 February.

More flexibility for you to save regularly

You no longer need to make monthly payments into the Regular Saver account. And whenever you want to make a deposit, the minimum amount is now just £10, down from £25. These changes will help more Members to save as and when they can.

Reduced minimum withdrawal limit

Our minimum withdrawal for our Regular Saver account is now £10, from £25. And you can still make two withdrawals each calendar year. If you make more than this, we’ll switch you to an Easy Access account to better suit your needs.

Open more than one Regular Saver – for just £10

You can now open more than one Regular Saver account. This means you can save for different things in separate accounts. The minimum opening balance is now just £10 too, down from £25. And you only need £10 to keep it open. The account currently offers a variable interest rate of 3.75% gross* p.a./AER**.

Increased maximum total investment of £500,000

We’ve increased our maximum total balance per Member from £125,000 to £500,000. This means that our Members have more flexibility when they save across our range of ethical savings accounts.

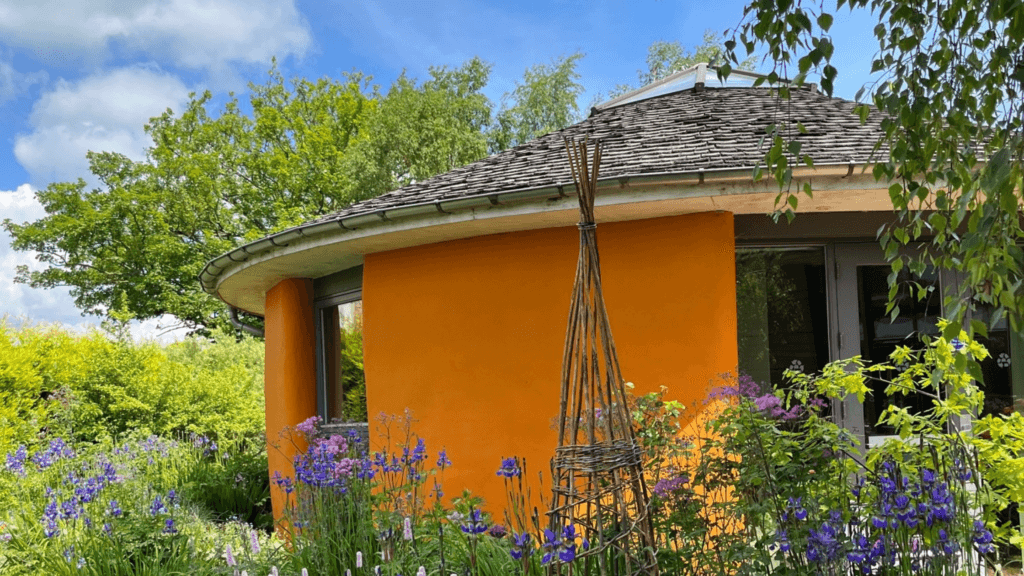

Our savers help to build a more sustainable future

Thanks to our amazing savers, we were able to fund 276 sustainable properties and projects in 2023. Check out our See where your money goes map to find out more.

Thank you for your continued support, as we work to create a fair society in a sustainable world.

*We pay all savings interest gross, which means that no tax is deducted. It’s your responsibility to pay any tax due, based on your individual circumstances. Tax rules may change in future.

**AER stands for Annual Equivalent Rate and provides a means of comparing interest rates by showing what the rate would be if interest was paid and added once a year.