Affordable Local Homes Mortgage

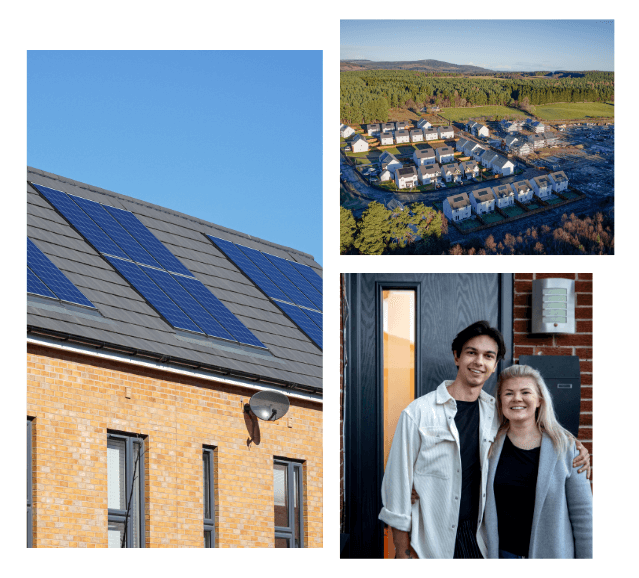

Our Affordable Local Homes mortgage is designed for people purchasing or remortgaging Discounted Market Sale Homes. We're here to help you to set up home affordably, locally, and fairly.

Your home may be repossessed if you do not keep up repayments on your mortgage

Trusted since 1981

Pioneers in providing mortgages that have a positive environmental and social impact

Experts in specialist mortgages

We’ve lent to over 4,500 unique properties and projects

Flexible decision making

We take a case-by-case approach to every project

Empowering local communities

We fund the development of community-led housing projects and support affordable housing

Open to the unusual

We’ll consider a wide range of non-standard construction types

At Ecology, we’ve always believed that it’s important for people to have the opportunity to own their own home. That’s why we’re delighted to provide mortgages for people looking to purchase a Discounted Market Sale Home.

A Discounted Market Sale Home (DMSH) is a property that can be purchased at a discounted price. This means a lower deposit will be required to fund the purchase and you’ll pay less on your mortgage than you’d usually do. Terms and conditions apply.

- We’ll lend based on a full affordability assessment and at a maximum Loan to Value of 95%.

- Applicants must be aged 18 years or over. The mortgage is only available to UK residents.

- A maximum mortgage term of 35 years is available (subject to eligibility).

- Mortgages are available on a repayment basis only.

- The property must have a minimum EPC rating of C or higher. If the property is a new build in development, please provide a copy of the predicted energy assessment.

- If the property was built in the last 10 years, the property must have an acceptable build warranty (subject to eligibility).

- The mortgage is available for non-standard construction types (for example, timber frame or clad) providing the property complies with the Society’s requirements.

- This product is available to all property located in the UK.

- The discounted market sale agreement must include a Mortgagee in Possession Clause in England and Wales (or a Rural Housing Burden Agreement in Scotland), to allow the lender to resell the property in the event of repossession. This must be linked to locality or wage index (not profession).

- This product is not eligible for C-Change Discounts.

- Builder Gifted Deposits and Incentives are not accepted.

Let’s say a property’s full market value is £250,000, but it’s offered at a 30% discount. You’d pay £175,000, and we could lend you up to 95% (£166,250) of the discounted figure of £175,000. Your mortgage would be based on that discounted price.

Affordable Local Homes

- No application fee

- Available for house purchases or re-mortgages (subject to eligibility)

- We support non-standard construction (e.g. timber frame)

- Maximum loan size is £750,000

Representative example

This is an illustration of a typical mortgage and its total cost. It looks at a mortgage of £225,000, paid over 35 years on a discounted variable rate of 5.54%. This mortgage would need one monthly payment of £2,022.30 and 419 monthly payments of £1,214.19 to pay off. The total amount paid would be £510,767.91. This includes the loan amount (£225,000), interest (£285,437.91), and a valuation fee (£330). This illustration assumes the cost of the property is £350,000.

The overall cost for comparison is 5.7% APRC representative.

APRC (Overall Percentage Rate of Change) shows you, as a percentage, the annual cost of a secured loan or mortgage. It brings together all charges (such as fees and other costs), calculated as if you kept your secured loan or mortgage for the full term without changing it.

Fees and charges

- An early repayment charge is not applicable to this mortgage, and you are free to overpay or repay the mortgage in full at any point during the mortgage.

- A minimum interest rate of 3% applies to the product. This means the interest rate for this product will never fall below 3%.

- No application fee is payable with this product but our standard valuation fee will apply

- Read our tariff of charges for more information.

Our awards

NaCSBA Gold Partner - 2025

Mortgage calculator

Our mortgage calculator is for illustrative purposes only and is designed to give an indication of the amount that we may be able to lend. The actual amount that we may be able to lend will depend on a full assessment of affordability, the property value and the size of your deposit.

Your home may be repossessed if you do not keep up repayments on your mortgage

Affordable Local Homes FAQs

To speak to our friendly mortgage advisors, you’ll need to provide your financial details to obtain a decision in principle. When you’re ready to fully apply, you’ll need to have a specific property in mind. When you’re ready to apply for the mortgage, we’ll ask you for:

- Income & expenditure documents

- A copy of the Energy Performance Certificate (EPC) for the property

- A copy of the build warranty or building certificate (if applicable)

- A copy of your discounted market sale agreement (sometimes known as a section 106 agreement)

Eligibility varies by scheme, but you typically must:

- Be a first-time buyer (or not currently own a property)

- Live or work in the local area

- Meet income or affordability criteria

- Intend to live in the property (not rent it out)

Check with your local authority or housing provider for exact criteria.

A DMS property is a home sold at a discount from the full market value, usually between 20% and 50%, to help eligible buyers afford homeownership. The discount is typically offered by a local authority or housing provider and stays with the property, even when you sell it later.

The property must have a minimum EPC rating of C or higher to be eligible for this product. If the property is a new build and not yet fully completed, please provide a copy of the predicted energy assessment.

An EPC (Energy Performance Certificate) rating is a measurement of the energy efficiency of a building. It is typically required when selling or renting a property in many countries, including the UK. The rating is based on factors such as insulation, heating systems, and the overall energy use of the property.

The rating scale typically ranges from A (very efficient) to G (inefficient), with A being the best and G being the worst. A higher EPC rating indicates that the property is more energy-efficient, which can mean lower energy bills and a smaller environmental impact.

If the property was built in the last 10 years, the property must have an acceptable build warranty or a Professional Consultant’s Certificate, for any property constructed more than 10 years ago, this is not required.

You will need a minimum deposit for a purchase of 5% or for a remortgage a minimum of 5% of equity remaining in the property.

For a purchase you can borrow up to 95% of the purchase price or valuation (whichever is lower), for a remortgage we can cover any secured lending on the property or any works to be spent on improving the property.

The mortgage has no early repayment charge so has flexibility to make overpayment off the mortgage at any point.

You’ll need a solicitor to:

- Review the resale restrictions

- Register the discount covenant (if applicable)

- Explain any Section 106 agreements or planning conditions

They’ll also make sure the mortgage and title are handled correctly.

Yes. Please bear in mind that we don’t offer mortgages for second homes, holiday homes or homes classed as mobile planning.

The mortgage is available for non-standard construction types (eg timber frame/clad) providing it complies with our ecological requirements, buildings insurance can be obtained, and the valuer confirms the condition and marketability of the property are satisfactory.

Get in touch

Simply fill in the form and one of our qualified mortgage advisers will be in touch to discuss your options

Our customer projects

-

Customer project

Crofts Court by Oxfordshire Community Land Trust

Project type: Community-led housing

Introduction to Oxfordshire Community Land Trust Oxfordshire Community Land Trust’s mission is to help solve Oxfordshire’s housing crisis through the provision of permanently affordable homes, and to act as a positive example for other community land trusts throughout the UK. Today, the need for affordable homes has never been greater with ...

ReadSee all projects -

Customer project

Chapeltown Cohousing: Strength in Diversity

Project type: Community-led housing

“It might not be everyone’s idea of paradise, but we’re very fond of Chapeltown. This is where we belong and we want to see it flourishing.” That’s the word on the street at Chapeltown Cohousing (ChaCo) – a community-led housing project in Leeds, West Yorkshire. Formed in 2010 following some impassioned conversations between neighbours, ...

ReadSee all projects -

Customer project

Jessie & George’s Story: Affordable People-Powered Housing

Project type: Community-led housing

London-based artists Jessie and George wanted to find an affordable property that they could treat as a home, not just an investment. Given the pressures of London’s inflated housing market, it was a challenge for them to find somewhere suitable, their options eventually becoming limited to the city’s outskirts. Keen to return to their ...

ReadSee all projects