| 5.00pm | Registration and refreshments |

| 6.00pm | Annual General Meeting including Ask the Directors |

| 7.20pm | Our new purpose |

| 7.30pm | Refreshments |

| 8.30pm | Close |

Archives: Faq

Holds our products and product specific data

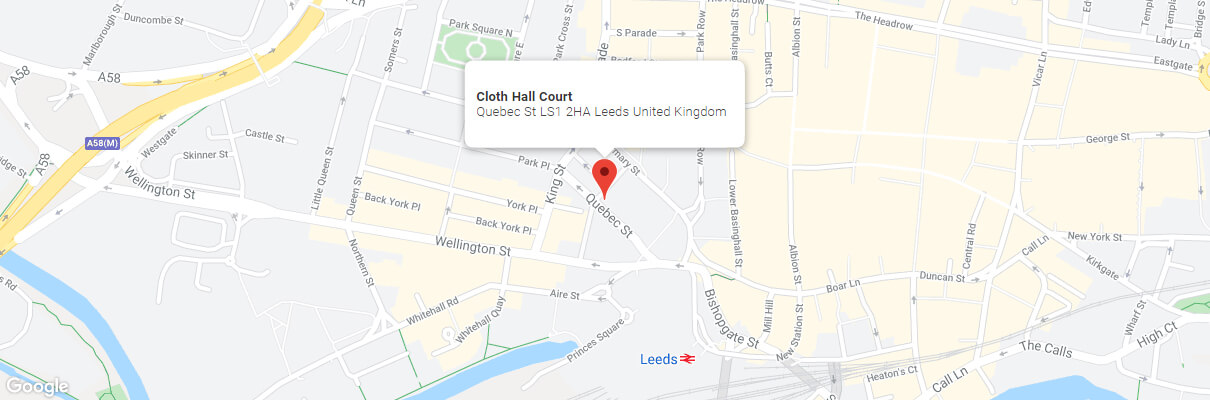

How to get there

Cloth Hall Court is in Leeds city centre, located on Quebec Street just a 2-minute walk from Leeds train station. Leeds train station connects Leeds with major UK cities. For train information and timetables visit the National Rail Enquiries website.

Cloth Hall Court is also just a 15-minute walk from Leeds coach station. For coach details, visit the National Express website. Most coaches arrive into Leeds Bus Station. For local bus information and timetables, visit the West Yorkshire Metro website.

There isn’t car parking available on site so we encourage you to use public or another mode of transport where possible. For bike routes and information about cycling in Leeds, visit the Leeds City Council cycling pages.

Please click the image to open in Google Maps:

How to vote

Voting is your chance to shape how your Society is run. Vote in a way that suits you – online, by post, or in person at our AGM – and the voting process is quick and easy.

As an eligible Member, you will receive an AGM voting pack via post or email. The pack also contains our Annual Review and Notice of AGM which includes information relating to AGM resolutions.

Simply visit ballot.ukevote.uk/ecologyagm24 to vote online; or scan the QR code on your paper proxy voting form. Alternatively, you can complete the voting form in your AGM voting pack and post it back to us, free of charge.

This year’s voting will be administered by UK Engage, a leading election services provider.

We’ll donate 50p to environmental charity Trees for Cities for every Member who votes online (20p for those voting by post). We’ll also donate £1 to if you choose to go paperless and receive future voting packs by email, which helps reduce our paper use.

Please ensure we receive your vote by 22.59pm on Monday 22 April 2024.

Register to attend our AGM

This year’s AGM takes place at Cloth Hall Court, Quebec Street, Leeds, LS1 2HA.

We’ll also be hosting the event online, so that more people can attend.

You can find out more and register to attend by visiting our dedicated Eventbrite page at ecologyagm2024.eventbrite.co.uk. If you can’t register online, please contact us on 01535 650770 to reserve your place.

Why attend?

We're owned by our Members and put their interests first, so if you're a part of Ecology we want to hear what you think.

Our AGM is your opportunity to:

- Meet the Ecology team and share your views on our work

- Hear about our 2023 performance

- Meet other Ecology Members in a friendly environment

How to apply if you are under 18 years old

Young person (16-17 years old)

An account can be opened by a young person aged 16-17 years with a bank transfer from an account in their name. You must complete an application form and send it to us. See the section on 'How to apply below'.

Alternatively, a parent, guardian or relative can open an account on their behalf (and in their name) with a bank transfer.

A covering letter that confirms the relation to the young person and declares that the money will be used by the young person must also be provided during the application. We will need to verify the identity and address of the young person. For details of how this is done, please read the Savings Account Identification document. You can find this below.

Child (under 16 years old)

An account can be opened by a parent, guardian or relative as a trustee for a child under the age of 16 years, by making an initial deposit from an account held in their name.

Applicants (parents, guardians or relatives, and the child) must each have their identity verified in accordance with the information provided in the Savings Account Identification Requirements document. A birth or adoption certificate (original only), NHS Medical Card or National Insurance notification letter must also be provided during application.

How to apply for a 35-Day Notice account

Step 1.

Please read all the documents on the right before applying

Please read all the documents on the right before applying

Step 2.

Tick to download a 35-Day Notice account application form

Tick to download a 35-Day Notice account application form

Step 3.

Post your application form to us - please note, scanned copies are not accepted

Post your application form to us - please note, scanned copies are not accepted

Please note our identification requirements

list in case we request more information

Please read these documents and tick to download the application

Introducing our speakers

Colin Baines

Shareholder activist and ethical campaigner

Dan Capstick

Ecology Product Manager, Mortgages

Sara Edmonds

Director of Studio SeARCH and Coordinator at ACAN

Ele George

Former Ecology self-build borrower, engineer and green build leader

Rob Harrison

Editor, Ethical Consumer

Marianne Heaslip

Co-Founder and Technical Director, People Powered Retrofit

Chris Pyke

Founding member of Five Rivers Co-housing

Gisela Renolds

Executive Director, Global Link (Lancaster) Ltd

Lynne Sullivan OBE

Chair of the Good Homes Alliance and Interim National Retrofit Hub

About Bridge 5 Mill

Bridge 5 Mill was established and refurbished by a dedicated group of people who had a vision for a centre in Manchester that could be a hub and resource for groups, organisations and individuals working on environmental and social issues.

The original project was called the Manchester Environmental Resource Centre Initiative (MERCi) and was established in 1996 as an independent charity. MERCi found and purchased Bridge 5 Mill and refurbished it with the help of grants from the European Regional Development Fund, a private trust, The National Lottery Community Fund and the Esme Fairburn Trust, and later the Tudor Trust and Comic Relief.

The mill was refurbished using many reclaimed and recycled materials, eco paints, water saving measures and low energy fittings (and no PVC!). It also involved a range of people with different skills and backgrounds, such as New Deal apprentices from the local community, participants of ‘Building on Equality’ – a green construction course for lone parent women – and many volunteers, all of whom were led by professional craftspeople who shared their knowledge and expertise.

If you want to know more about the venue, please go to bridge5mill.org.uk/about